Writtle 2020 Annual Report and Accounts

CHAIRMAN’S STATEMENT

I am pleased to report a satisfactory performance in 2020 despite the long shadow cast over our lives and livelihoods in the year by the Covid-19 pandemic.

All our businesses were impacted by the economic downturn caused by global government measures to combat the pandemic, but our management teams adapted well and continued to give our clients a first-class service throughout the year. Although we decided that two of our smaller loss- making businesses should leave the group, overall these results are testament to the quality of our ongoing businesses and their people, supported by Writtle’s strong balance sheet and prudent cash reserves which enabled us to weather the worst of the storm.

Writtle has emerged from the year stronger than it went in, and we were particularly pleased to have been able to restore shareholder dividends during the year, and now to be in a position to declare our fourth Special Dividend.

RESULTS AND ORDINARY DIVIDENDS

Turnover was £66.89m (2019: £78.41m) and profit before tax was £3.55m (2019: £5.39m).

Excluding our discontinued businesses, continuing turnover was £65.58m (2019: £75.05m) and profit before tax was £5.12m (2019: £5.51m).

Net cash at the year-end was £14.93m (2019: £8.28m) as cash management was prioritised.

The directors are recommending a final dividend of 12.00p (2019: 12.00p) making total ordinary dividends for the year of 18.25p (2019: 18.25p).

Subject to shareholders’ approval, the final dividend will be paid on 28 May 2021 to shareholders on the register at 25 March 2021.

SPECIAL DIVIDEND

The company’s policy is to distribute to shareholders cash balances above £5m for which the company has no immediate investment or acquisition use. Last year, these criteria were met but considering the threat posed by the pandemic a Special Dividend was not paid. This year, although we are still living with the effects of the pandemic, we feel confident enough to declare a Special Dividend of 60.00p per share (2019: nil) which will be paid on 30 April 2021 to shareholders on the register at 25 March 2021.

PRINCIPAL ACTIVITIES

Writtle is a UK-centred marketing services group with an international client base.

For reporting purposes, we group our businesses into three headings: Innovation, Implementation and Instore, which describe their principal marketing focus. Writtle also has a property company that owns the freehold properties from which some of its companies operate.

Writtle’s operating model in its group companies continues to be based on Equity Involvement and Decentralised Growth.

Equity Involvement – Whether a group company was a start-up or acquired, Writtle will typically hold a majority shareholding alongside management which creates a motivational structure where Writtle and management’s interests are aligned. Alongside traditional bonus schemes, Writtle encourages its group companies to adopt a dividend policy to reward further its management and Writtle. Additionally, to encourage collaboration across Writtle group companies, Writtle has an annual share option award and encourages employee ownership of Writtle shares which are traded internally on a matched bargain basis, normally once a year. The result of this equity involvement is that managers of Writtle group companies behave like owners and have further incentive to promote the success of Writtle as a whole.

Decentralised Growth – Writtle looks for businesses in the marketing services sector which can demonstrate potential for further growth either organically or by acquisition. These businesses will typically be led by ambitious industry experts who will identify the best growth paths through their own experience. Rather than dictating policy or acquisition strategy from the centre, Writtle will support its management teams to grow their businesses, adding value through Writtle’s management experience and funding capacity. By enabling management to part-own and plot the development of their businesses, Writtle has proved to be a highly attractive workplace for the best talent in our industry, and our results and employee retention over the past 10 years bear witness to this.

REVIEW OF BUSINESS

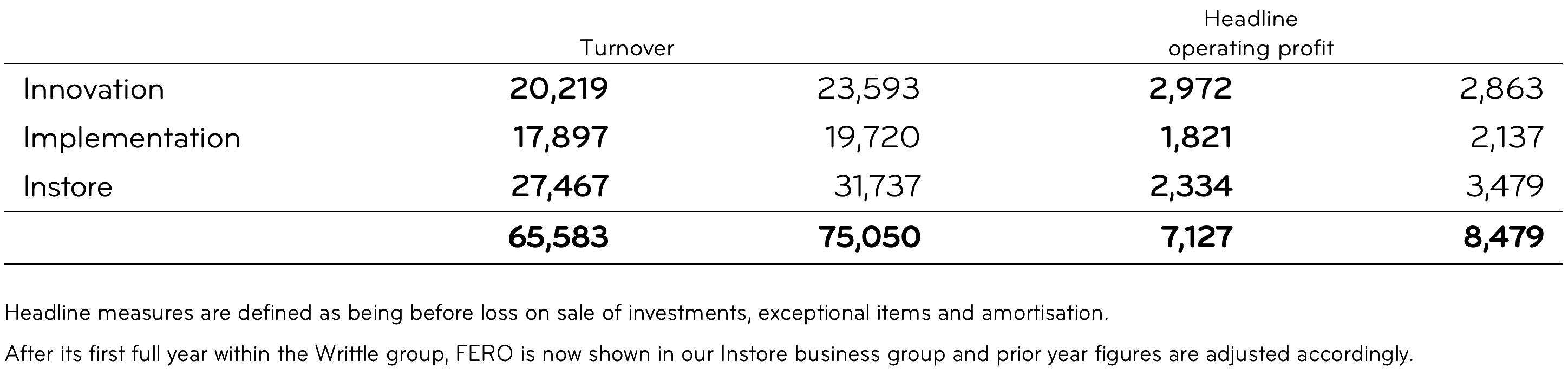

The performance of Writtle’s three business groups, excluding discontinued businesses, is shown in the following table:

Overall, the decline in turnover and headline operating profit caused by the economic downturn were 13% and 16% respectively and although performance differed between the business groups, they all remained profitable.

Our Innovation businesses performed best with our two largest agencies, Epoch and Seymourpowell seeing little drop off in demand as their clients increased momentum in digital transformation, with particular emphasis on our virtual and augmented reality capabilities. The Team’s strategy and communications offer also performed strongly after a slowdown in the second quarter. The performance of these three agencies largely offset the decline of our smaller branding and design agencies whose clients in hospitality, high street retail, sport and travel cut expenditure sharply. It was decided to divest two small agencies, while another two, Williams Murray Hamm and Identica were merged as one business and saw a recovery in the fourth quarter which has continued into the current year.

Our Implementation businesses have a strong presence in food retail which was largely unaffected by the pandemic, and this underpinned a highly creditable year on year result. Other of our clients in travel and high street retail were badly affected with revenues almost disappearing but our management teams did particularly well to redesignate staff in these departments to busier areas whilst awaiting an upturn in their own. The backbone of our Implementation businesses has been the development in recent years of our proprietary technology system ‘MyBrandstream’. This system is soon to be installed in several major clients providing a workflow, approvals, digital asset management and reporting tool, which increases both our traction with the client and volume of their work we can undertake.

Our Instore businesses, Arken and FERO, were hardest hit by the pandemic. Both have manufacturing businesses with high street retail the primary outlet for their products and the first lockdown in March saw orders and deliveries virtually disappear outside food retail and pharmacy clients. Most of our group businesses used the Coronavirus Job Retention Scheme but none more so than Arken and FERO. Both businesses retained only a small workforce to fulfil the few client orders they had during the first lockdown, with the majority being furloughed until order books improved. While Arken had made a good start to the year and stretched

its remaining order book across the rest of the year to remain profitable, FERO had recorded substantial losses in the first half. It was therefore remarkable that FERO was able to bounce back quickly once the first lockdown ended, and the final four months of the year saw FERO cope with high levels of pent-up demand to recover all its losses and move into profit for the year. As order books improved, staff returned from furlough to increase our capacity and over the course of the year there is no doubt that the Coronavirus Job Retention Scheme achieved its aims.

For more details of individual operating company activity throughout the year, please refer to the reviews which follow this statement. Apart from overlaying similar financial controls, Writtle encourages individual company autonomy and identity, and the reviews reflect the character of each business.

CORPORATE ACTIVITY

Writtle had two major transactions under review at the time the pandemic struck. It is too early to say whether either might be resurrected but there are likely to be further opportunities as the economy recovers. Our longstanding aversion to high debt levels and earn outs, combined with our motivational operating structure contributed to a strong performance relative to others in our sector. In addition to organic growth, Writtle is well positioned to expand by acquisition, with focus on larger transactions.

Writtle completed a significant internal corporate restructuring during 2020. Over the past few years, I have reported that several of our Implementation businesses have traded within a new group identity, Branded, to give clients a single point of contact for a wide array of implementation services. This has particularly appealed to larger brands and retailers who have increasingly sought providers of scale with excellent credentials, global reach, and strong finances rather than engaging multiple smaller agencies in each geographic market. This approach has been highly successful in expanding the breadth of services we provide to clients and in winning new clients. We have therefore formalised Branded as a separate trading company within Writtle, and it has acquired the minority shareholdings in most of those companies that have been trading as part of Branded, in exchange for shares in Branded. Our US operations already trade as Branded which, unlike Writtle, is a client facing brand and business. In the review of operating companies following my statement we identify those group companies that are part of Branded, which now includes some of our Innovation and Instore businesses and together they generate annual turnover in excess of £35m.

There will be a share trading opportunity this year (after a pause last year due to the pandemic) and shareholders who wish to participate, either buying or selling, should follow the guidelines in the letter accompanying this report. If there are excess shares available for sale once existing shareholder demand has been satisfied, Writtle may choose to use its Employee Share Ownership Trust (ESOT) to buy shares or offer them to new investors.

CURRENT TRADING

The third lockdown has inevitably delayed a full recovery across all our group. Demand in our Instore businesses will remain subdued until restrictions on all retailers are lifted, but with costs and overheads reduced last year, and continued use of the furlough scheme where necessary, we have avoided significant losses in these businesses and are well placed to benefit from the predicted economic upturn later in the year. Our Innovation and Implementation businesses have started the year well and we anticipate another good performance.

In summary, Writtle performed ahead of even the most optimistic forecasts at the outset of the pandemic in March 2020. Although some of that success can be attributed to our prudent business approach over many years, most of the accolades must be given to our excellent people who endured personal and professional hardship without compromising client service throughout the most extraordinary of years. I thank them all.

Robert Essex

Chairman

9 April 2021