Writtle 2022 Annual Report and Accounts

CHAIRMAN’S STATEMENT

I am pleased to report on Writtle’s results for 2022.

Following a strong second half, turnover for the year grew by 14% but profitability was held back by well publicised cost increases of staff, materials and latterly energy.

We were nonetheless pleased to finish the year in a strong financial position enabling Writtle to increase its annual dividend and declare a sixth Special Dividend.

RESULTS AND ORDINARY DIVIDENDS

Turnover was £77.17m (2021: £67.93m) and headline profit before tax was £4.39m (2021: £5.43m).

Exceptional costs of £1.37m included a non-cash write down of £1.06m of capitalised software development following an impairment review. The remaining exceptional costs related to restructuring and aborted acquisition costs partially offset by a profit on disposal of a freehold property. After these exceptional items and goodwill amortisation statutory profit before tax was £2.31m (2021: £5.19m)

Net cash at the year-end was £11.96m (2021: £15.13m).

The directors are recommending a final dividend of 14.00p (2021: 13.25p) making total ordinary dividends for the year of 21.00p (2021: 20.00p).

Subject to shareholders’ approval, the final dividend will be paid on 26 May 2023 to shareholders on the register at 29 March 2023.

SPECIAL DIVIDEND

The company’s policy is to distribute to shareholders cash balances above £5m for which the company has no immediate investment or acquisition use. Having been frustrated by factors outside our control in pursuing acquisitions over the last two years, we are more actively investing in our own businesses to expand capacity and open new markets this year. The economic downturn continues to present acquisition opportunities and our continued cash generation means we have sufficient financial resources to consider these as well as rewarding shareholders for their ongoing support. We are therefore pleased to declare a Special Dividend of 25.00p per share which will be paid on 28 April 2023 to shareholders on the register at 29 March 2023.

PRINCIPAL ACTIVITIES

Writtle is an international marketing services group.

For reporting purposes, we group our businesses into three headings: Innovation, Implementation and Instore, which describe their principal marketing focus.

Writtle’s operating model in its group companies continues to be based on Equity Involvement and Decentralised Growth.

Equity Involvement – Whether a group company was a start-up or acquired, Writtle will typically hold a majority shareholding alongside management which creates a motivational structure where Writtle and management’s interests are aligned. Alongside traditional bonus schemes, Writtle encourages its group companies to adopt a dividend policy to reward further its management and Writtle. Additionally, to encourage collaboration across Writtle group companies, Writtle has an annual share option award and encourages employee ownership of Writtle shares which are traded internally on a matched bargain basis, normally once a year. The result of this equity involvement is that managers of Writtle group companies behave like owners and have further incentive to promote the success of Writtle as a whole.

Decentralised Growth – Writtle looks for businesses in the marketing services sector which can demonstrate potential for further growth either organically or by acquisition. These businesses will typically be led by ambitious industry experts who will identify the best growth paths through their own experience. Rather than dictating policy or acquisition strategy from the centre, Writtle will support its management teams to grow their businesses, adding value through Writtle’s management experience and funding capacity.

By enabling management to part-own and plot the development of their businesses, Writtle has proved to be a highly attractive workplace for the best talent in our industry, and our results and employee retention bear witness to this.

REVIEW OF BUSINESS

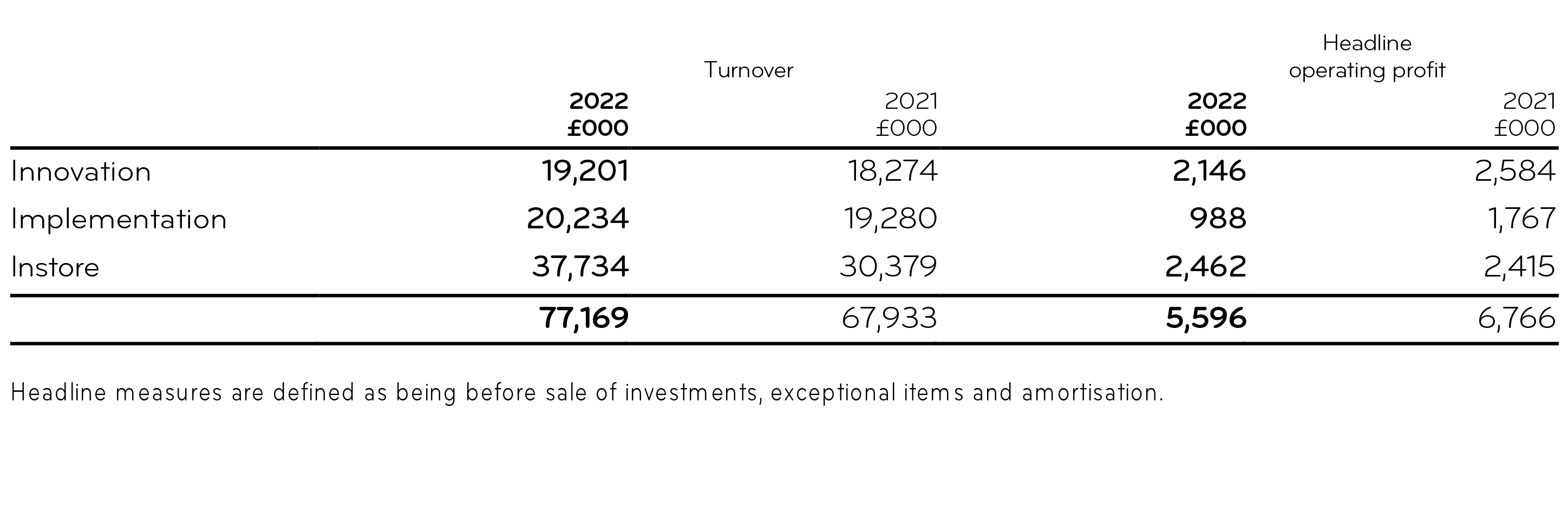

The performance of Writtle’s three business groups, before central costs, is shown in the following table:

Led by Epoch, our Innovation businesses again performed well. Turnover grew by 5% but profit was held back by increased investment in staff as we looked to strengthen our position in our areas of expertise, with particular emphasis on digital transformation.

Led by Epoch, our Innovation businesses again performed well. Turnover grew by 5% but profit was held back by increased investment in staff as we looked to strengthen our position in our areas of expertise, with particular emphasis on digital transformation.

Our Implementation business Branded grew turnover by 5% but suffered a disappointing fall in profits as downward pressure on pricing was applied by clients in an increasingly competitive UK market. The business is therefore undergoing a restructuring in the UK to improve profitability. Allied to this are initiatives to reduce our dependency on the UK market and lower our cost base, primarily by increasing our presence in the US and India respectively. Branded already enjoys revenues from the US but has recently opened a new office in Miami from which to expand its US client base. India has long provided outsource partners for Branded but we are now looking to strengthen our formal relationships and therefore counteract the margin pressures faced on some UK-sourced production.

Our Instore business group increased both turnover and profit. Fero continued its upward path to record the highest turnover and profit of any Writtle company and Arken recovered strongly in the second half to turn around its first half losses. Faced with well publicised labour shortages, raw material increases and towards the end of the year escalating energy costs, the performances of both companies were all the more impressive.

For more details of individual operating company activity throughout the year, please refer to the reviews which follow this statement. Apart from overlaying similar financial controls, Writtle encourages individual company autonomy and identity, and the reviews reflect the character of each business. Writtle is also supporting each of its businesses to achieve B Corp Certification as part of the group’s ongoing commitment to meet the highest standards of social and environmental performance, transparency and accountability, and this initiative has been greeted enthusiastically by employees. Fero has become the first Writtle company to receive B Corp Certification and we expect other companies to follow soon.

CORPORATE ACTIVITY

We were considering an IPO at this time last year but a combination of a deterioration in stock market conditions for smaller companies and a worsening economic outlook has persuaded us to postpone our plans. There is little point in bearing the cost of having a quoted share price if there is low appetite from institutions to invest in smaller companies and the resulting illiquidity in our shares would create share price volatility and lessen our ability to use shares for acquisitions or fundraising.

Our strong balance sheet, cash balances and track record have not gone unnoticed in our sector, and we are approached by potential vendors of companies on a regular basis. There is however a scarcity of opportunities that fit our criteria of scale and being able to add value through turnaround or investment, but we are actively seeking opportunities.

This healthy cash position has also enabled us to invest in our own businesses. Most of our recent investment has been focussed on Fero with a refurbishment of its premises and several machinery upgrades completed in the year. After extensive trials Fero has recently ordered a high speed single pass digital print machine which will significantly increase their capacity and widen their target markets as the business continues to grow.

Given that there is still no public market for our shares, we will again be offering a share trading opportunity this May and shareholders who wish to participate, either buying or selling, should follow the guidelines in the letter accompanying this report. If there are excess shares available for sale once existing shareholder demand has been satisfied, Writtle may choose to use its Employee Share Ownership Trust (ESOT) to buy shares or offer them to new investors.

CURRENT TRADING

Following a strong finish to 2022 we are expecting a quieter start to the year with the usual seasonal uplift in trading in the second half. We have already secured some impressive projects, particularly in our Innovation businesses, which gives us good visibility for the year ahead.

Robert Essex

Chairman

31 March 2023